A lot of people think that Bitcoin has crashed. They heard the news that Bitcoin went to an all-time high of $73,500 and now it has crashed to $63,000. They think that Bitcoin has lost its steam and might not have much action going forward.

Bitcoin made a similar move around March 2020. It went all the way down to around $6,000 but by the end of 2020, it started going on a parabolic bull run to $69,000.

Many people think that Bitcoin is risky because it is volatile. Bitcoin is not risky. And not all non-volatile things are safe. Cash in dollars or your local currency is very stable (short-term) but gradually loses value in the long term. Bitcoin is volatile in the short term but keeps going up in value in the long term.

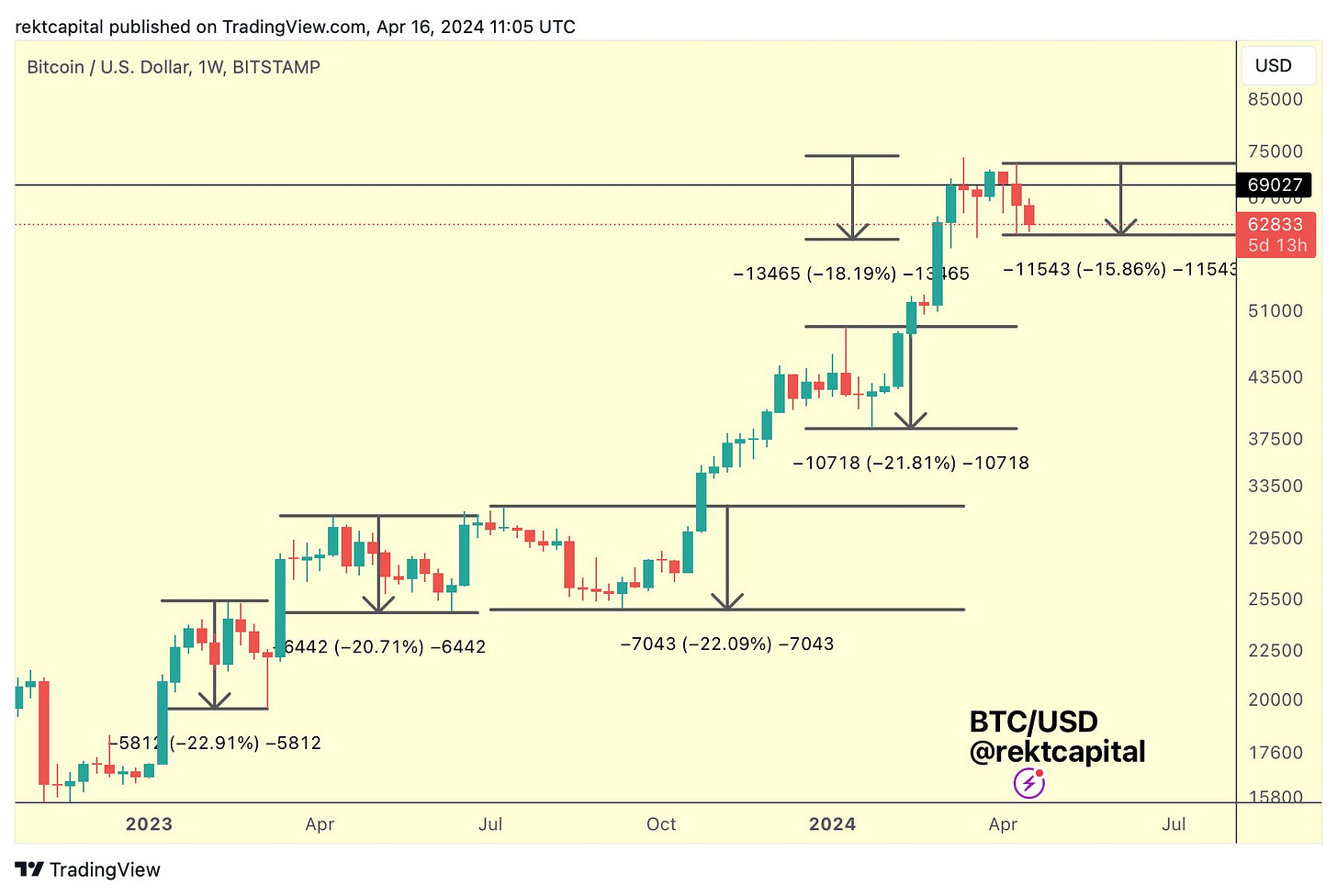

Here is a list of all Bitcoin pullbacks dating to the Bear Market Bottom of 2022:

-23% (February 2023)

-21% (April/May 2023)

-22% (July/September 2023)

-21% (January 2023)

-18% (March 2023)

Bitcoin is uncontrolled and unregulated. There are no circuit breakers and it trades on the weekends too. It goes up and down on people’s fear and greed and people’s emotions cannot be regulated.

Here’s a chart of all the Bitcoin pullbacks by Rekt Capital

Many industry analysts have predicted that before Bitcoin halving (the 4th halving is expected to happen 2 days from now) the price usually comes to a non-exciting level. There is not much movement in the price and it goes on a slow grind downwards making investors very stressed out.

Bitcoin moves opposite to the stock market. The stock market moves up slowly and gradually for a long time until a black swan event comes around and crashes the whole market.

Bitcoin moves sideways and down for most of the time until it “crashes” upwards suddenly in a few-week period. That’s why it’s so hard to HODL Bitcoin. It’s painful to see most of the time and the rush of upward movement comes in a very short time.

Volatility is the price that you pay for long-term price appreciation. It is volatile only when you calculate it in dollar terms. 1 Bitcoin is always 1 Bitcoin. Check Bitcoin’s price in Turkish Lira or Argentinian Pesos, it is wildly up because those currencies have hyper-inflated.

The dollar hasn’t yet hyper-inflated because the world uses the dollar as the reserve currency and it has a lot of demand because dollar-denominated debt has to be repaid in dollars.

Post-Halving Parabolic Move

After the halving, the daily production of Bitcoin will go down from 900 Bitcoins per day to 450 Bitcoins per day. The supply shock usually doesn’t show in the charts immediately. It takes 3-4 months after the halving for the price to go parabolic from where we are right now.

The current move from $20k to $70k is not the move that Bitcoin does after halving. If you look at the previous 2 cycles, the post-halving parabolic move happens after at least 6 months of the halving.

The black lines show the post-halving move and the red line that you see is the pre-halving move. The current move is similar to the small move that you see in 2020. If this “small move” is so big, as big as the previous post-halving move, we can only imagine how big this post-halving move will be.

2025 will be the golden year for Bitcoin. The all-time high for Bitcoin in this cycle ideally should happen in 2025 if history is going to rhyme. Patience until then.