Why Bitcoin is so Volatile

Wouldn't it be nice if Bitcoin's price keeps going up steadily?

A lot of people ask me why Bitcoin's price is so volatile. Why can't it go up in a smooth and predictable 50% year-on-year curve? In this post let's look at the reasons why Bitcoin is so volatile and why you should be comfortable with it.

We are still on a dollar standard. We do not see the world priced in anything else. Many of the world's population still measures most of the goods in dollars.

The total supply of dollars in circulation goes up and down depending on people's debt levels. If everyone is in debt including the government and when debt is cheap, the money supply expands. When interest rates are high and debt is costly, people do not go into debt and keep repaying the debt which leads to the contraction of the money supply.

Bitcoin's price is an index of the cycles of money supply's growth and contraction. As demand increases, the price increases, but the movements in the price of Bitcoin shed some light on the state of the fiat money supply.

During times of monetary tightening, Bitcoin has always fallen in price (until recently) and during periods of monetary easing, Bitcoin's price has gone up along with tech stocks and real estate. Bitcoin might decouple from this cycle eventually because people will see the world through a Bitcoin lens.

Bitcoin trades across the world, in multiple exchanges, 24/7 without any holidays. Because it is decentralized, it cannot be shut down by anyone. There are no circuit breakers in Bitcoin.

In many stock exchanges across the world, the trading of the asset stops if the price goes too high in a day or too low in a day. You cannot control and tame Bitcoin like that. Apart from exchanges facilitating the buying and selling of Bitcoin, many people might be exchanging Bitcoin for other valuable goods and services as well.

Money goes through 4 stages: a collectible, a store of value, a medium of exchange, and then a unit of account. Bitcoin is mostly at the store of value stage and just testing the waters in the medium of exchange. Hardly anyone accepts or pays in Bitcoin but some still do and they are the early adopters.

Right now, people are seeing Bitcoin in dollar terms and thinking Bitcoin is volatile. 1 Bitcoin is always 1 Bitcoin. It's the dollar that's volatile if you see the world through a Bitcoin lens. When Bitcoin matures and the price becomes more stable, then it will be seen as a unit of account.

When I say the price will become stable, I am not talking about the price against fiat currencies. I mean that the purchasing power of Bitcoin for other goods and services might become stable. This will happen as more people adopt it and start accepting payments in Bitcoin.

Theoretically, if all the people in the world use Bitcoin to transact and store value for the long term, and no one trades Bitcoin for dollars, then there will be no exchange rate. Bitcoin's price will be infinite because no one will accept dollars in return for the Bitcoin that they have earned or bought already.

There is a good chance that Bitcoin's price against the dollar never becomes stable because the amount of dollars in circulation is never stable. It goes in cycles through debt issuance and debt repayments.

Some people argue that credit is important for investing in the growth of a business and capital expenditures. If the world is on a Bitcoin standard, it doesn't mean that there will not be any new debt issued. It will only mean that the debt is costlier. That's the real price of debt.

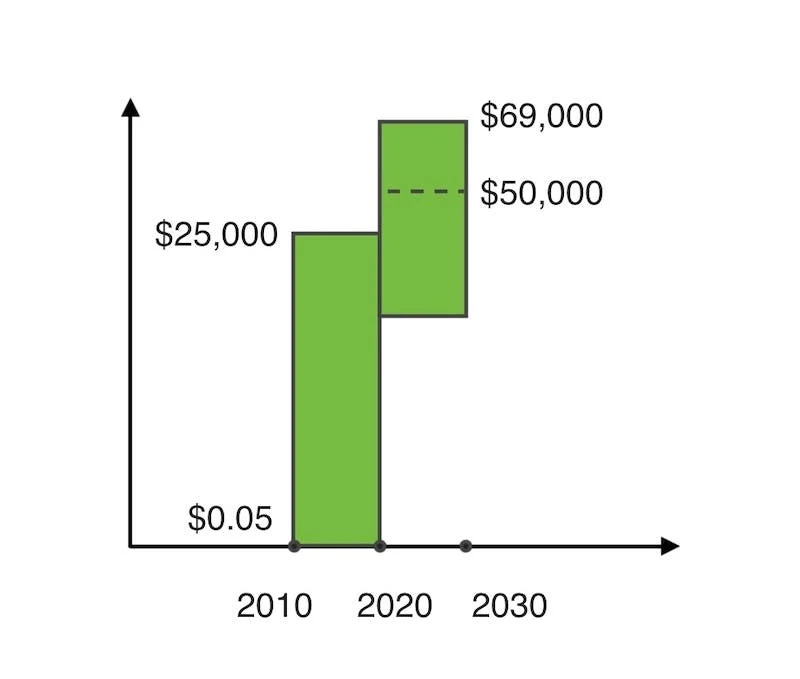

Someone lending (fiat) money to someone else might charge a 70-80% annual interest rate. 70-80% might seem a lot but it is less than 70% CAGR (compounded annual growth rate) of Bitcoin in the past 7 years in fiat dollar money terms.

So why would anyone lend money at a lower interest rate than the return Bitcoin gives them? If the world is on a Bitcoin standard where no one uses fiat money anymore, then the rate of interest will come down to match the competition for that debt.

If no one needs debt in a world where everyone is using Bitcoin as a currency and an asset, then the cost of debt will be 0%.

If only a small number of people need debt, the cost of debt might be 1%. If a lot of people need debt and the bidding for debt goes up, the cost of debt might be 5% which might be very high in a non-inflationary currency.

This might happen when the economy is growing so fast that someone taking the loan at 5% interest is confident of making more returns from his enterprise or venture than the appreciation of Bitcoin in purchasing power.

The interest rates for debt need not be fixed by a central bank. There needs to be no monetary policy to "watch" the economy and set interest rates accordingly. The free market will fix the price of debt.

The cost of debt will be based on demand and supply, just like anything else in the world, and not because someone thought that 5% was a good rate to "fix".

Some people argue that when the world was in a gold standard, people were not able to start new ventures because of a lack of debt. Debt still existed but the money didn't go around so much because gold is difficult to work with as money. Also, you cannot transfer gold from one part of the world to the other but you can send Bitcoin. So if a poorer country needs money, people from the rich country can transfer it via digital networks.

Bitcoin-based banks might take your Bitcoin or Satoshis as deposits and then lend it out to other people who are ready to pay a higher interest rate. Banks can offer interest in Satoshis for the deposits that people make. They can make profits from the spread between the cost of borrowing and lending.

The people who deposit their satoshis at a bank are the lenders to the bank and further to the end users. Banks will take care of the risk and repayments from the debtors. That's what the banks will charge for. A bank will not be able to lend out any money if people do not deposit their Satoshis at that bank. That means that banks have to be competitive in offering the best services and the highest savings rates for depositors.

When we reach such a world, Bitcoin will not only be the standard medium of exchange but also a unit of account. People will calculate the cost of everything in Bitcoin terms and they will observe that in Bitcoin terms, everything is getting cheaper all the time.

That's because Bitcoin doesn't inflate and as the productivity of the world goes up in a better system, everything is bound to get cheaper. Look at the price of anything in Bitcoin terms, it has been already getting cheaper in 5-10-year terms.

You feel Bitcoin is volatile because you do not zoom out. You don't understand that Bitcoin is at the price discovery phase right now. It's a long-term store of value. Anyone who has bought Bitcoin at any price is not at a loss if they were ready to wait for 5 years minimum. This will become 3 years and eventually 1 year. The volatility will reduce as the sellers reduce. Then we can expect a steady move upwards.

If you look at Bitcoin in 10-year charts, you see only green candles.

If you are using fiat currencies and saving in the same currency, you have accepted inflation as a part of the equation. And then you try to "make money" with other investments.

Life would be much simpler if we saved in the same currency. Loss of purchasing power in the currency that you use is the price you pay for enjoying price stability in the short term. If you save in that currency, eventually it will melt away due to inflation.

Short-term volatility is the price you pay for long-term price appreciation. That's the price that Bitcoin demands. As I keep saying, everything has a price to it. Most people who understand Bitcoin and the need for a non-inflationary currency do not bother about the volatility.

If I have 0.1 Bitcoin, I don't think I have $5000 worth of Bitcoin. I think that I have 0.1 Bitcoin. And my goal might be to get to 0.2 irrespective of the dollar price.

So if I earn more dollars than I spend, I can convert the remaining dollars into Bitcoin and save my money in Bitcoin. I might not need to diversify into real estate, stocks, or bonds. Some people might want to, but I might not want to. It depends on people's conviction in the asset.

Again, this is not financial advice. This information is for entertainment purposes only. There you go. Because my lawyer asked me to.