Why Bitcoin Beats Stocks, Bonds, Gold and Real Estate

Understand why Bitcoin is not just another investment like stocks or real estate.

Many people refer to buying Bitcoin as “investing in Bitcoin.” But buying Bitcoin is not an investment. If you are investing in something, you are taking a risk. You “invest” in stocks. You are lending money to someone hoping they will put the money to good use and give you dividends.

Right from childhood, we were taught to save money for the future. If we are earning money right now, we might not have the same earning opportunities in the future. So it is important to save money, be frugal, and ensure that even if we do not have an earning opportunity in the future, we can still maintain our standard of living for ourselves and our families.

The narrative has changed from having to save money to being a “smart” investor. The problem arises because money keeps losing value to inflation. If you earned $1000 this month and only spent $500 on your living expenses, the remaining $500 can be saved. If you keep that $500 in a bank, you will get a few percentage points in growth.

If you make a long-term deposit, the interest rate might be 5-10% depending on your country. Many "smart" people who are financial advisors will advise you to invest the money in gold, stocks, bonds, and real estate because they grow faster than 5-10%. When such investments are done with excessive leverage, it leads to asset bubbles.

Why do we need to "grow" our money in the first place? We need to grow it because the $500 will be worth only $250 in purchasing power after a few years. And we have to look for the best growth vehicle to beat the expansion of the money supply through debt.

Some people will beat inflation, some will not beat it and some will lose money trying to beat inflation because their investments were not the right ones. Because of the expanding money supply, new financial markets have emerged across all developed and developing countries. Many people in the finance industry, such as stock brokers, wealth managers, and banks, make just helping people "grow their money".

Wealth is not produced in the world by helping people grow their money. Wealth is produced in the world when people invest their time, energy, and ingenuity in creating products and services that people want to use in their daily lives.

These new financial markets have emerged because of the problem created by an ever-expanding money supply through debt. Until Bitcoin, there was no other way to protect yourself against the debasement of your currency.

An ever-expanding money supply has unintended consequences. People who think they are "smart investors" will be able to preserve their savings and other people, especially the people without a college education, lose their savings to inflation. This makes the rich richer and the poor poorer. It creates an unfair society.

For someone like you or me, instead of spending all our time creating products and services that people use, we spend half our time trying to make our money and the remaining half our time just protecting the money that we have already made.

To protect our money, we are forced to invest. They say we have to diversify our investments and the right allocations are not easy to decide. It takes a lot of time. That time is taken away from productive tasks that could create wealth for others in terms of products and services.

If we invest, we might lose money. If we do not invest, we will still lose money to inflation. This problem is artificially created using a form of money that is not hard to produce. This problem will not exist in a system with a limited supply of coins (such as 21 million).

Because we are forced to invest money just to keep our savings, which we have already worked hard to make, we are not the best engineers, doctors, or producers. The system is already forcing us to spend 30-50% of our time on being "financially smart". This need not be the case in a system with a better form of money.

This phenomenon of ever-expanding money supply also puts every saver money into real estate and stocks which creates bubbles in these markets. The way to prevent these asset bubbles is not regulation but to remove the root cause of these bubbles which is an ever-expanding money supply backed by nothing but debt.

When debt is defaulted on and if there is no confidence that the debt will be repaid in the future, it causes crashes in the markets. In 2008, people started defaulting on their housing loans, which crashed the housing prices, and then the banks failed.

Most of the houses were bought with debt-based money. Highly leveraged purchases. Because the debts were defaulted, it put the banks at risk. The powers that be tried to bail out these banks by flushing even more money into the system which was the cause of this bubble and crash in the first place.

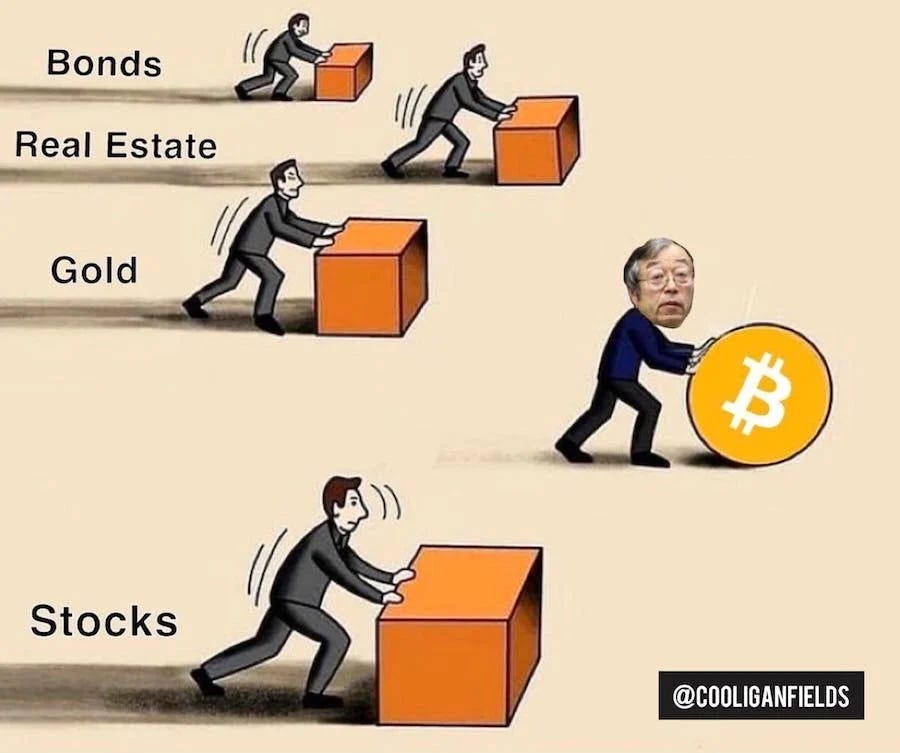

So far in the past 10 years, Bitcoin has given better returns than bonds, real estate, gold, and stocks because of the unique monetary properties of Bitcoin. If you want to check Bitcoin’s performance against various stocks and indexes, you can visit BitcoinVsStocks.com and compare it for yourself.

For example, if you had invested $250 a month for the past 5 years in Bitcoin, you would’ve made a 284% return. Compare this to the S&P 500 Index. It’s not even an apples to apples comparison.

Normal people think that Bitcoin is growing. Bitcoin is not growing. The supply of Bitcoin is only 21 million and each Bitcoin has 100,000,000 units which we call Satoshis. Bitcoin is growing in fiat terms because fiat money is always expanding in supply. Bitcoin is just a marker of how much inflation is happening in real terms and not just CPI.

Normal people think Bitcoin is an asset bubble. It is not an asset bubble because it is not a true asset in the first place like other assets. It's money itself acting like an appreciating asset.

When the money supply expands, Bitcoin price in dollar terms goes up. When money supply shrinks due to a recession or monetary tightening by the central banks, then Bitcoin price goes down. It's the dollar that is volatile against Bitcoin. That's seeing the world through a Bitcoin lens.

Bitcoin is the only asset class that doesn't increase in supply no matter how much the demand for it grows and it can never be changed by anyone. Bitcoin represents how much fiat currencies are expanding in supply.

Every time there is a crisis, governments across the world flush the economy with liquidity to "save the economy" from crashing. This is a never-ending cycle. The global debt can never be repaid and no one intends to repay all the debt because the very act of repaying the debt will shrink the economy and cause recessions.

It takes some time to let this worldview sink in. The fiat system is not very stable and it will create economic instability. You have to humble yourself, stop believing what you see on the news, and start thinking deeply about money, human energy, and debt.

When you think from the first principles, you will see the light. And Bitcoin will become the obvious solution to all the problems that the world is facing right now.

Reflect on what you learned today. Use less social media and more time thinking. Have some blank space in your day. While you are driving, do not listen to anything or speak to anyone. Just think about what you have learned. Look at all the shops and people around you. Think about why they use fiat currencies, and think about why they try to "save" that in other forms of "investments" rather than keep the money as it is for the future. You will start seeing the light. The orange light. The Bitcoin light.

When you convert your fiat currency into Bitcoin, you are not investing in Bitcoin. You are saving in Bitcoin instead of saving money in an inflationary currency which robs you of your purchasing power. You are not lending money to Bitcoin developers by buying a Bitcoin stock. You are just saving it for future use.

Bitcoin is volatile, but not risky if you deeply understand why Bitcoin is a better form of money. When you save in a deflationary currency, you need not force yourself to take a risk by investing just to protect your purchasing power.