The Debasement Trade (Gold and Bitcoin)

When Trust in Money Fades, People Look for Something Real

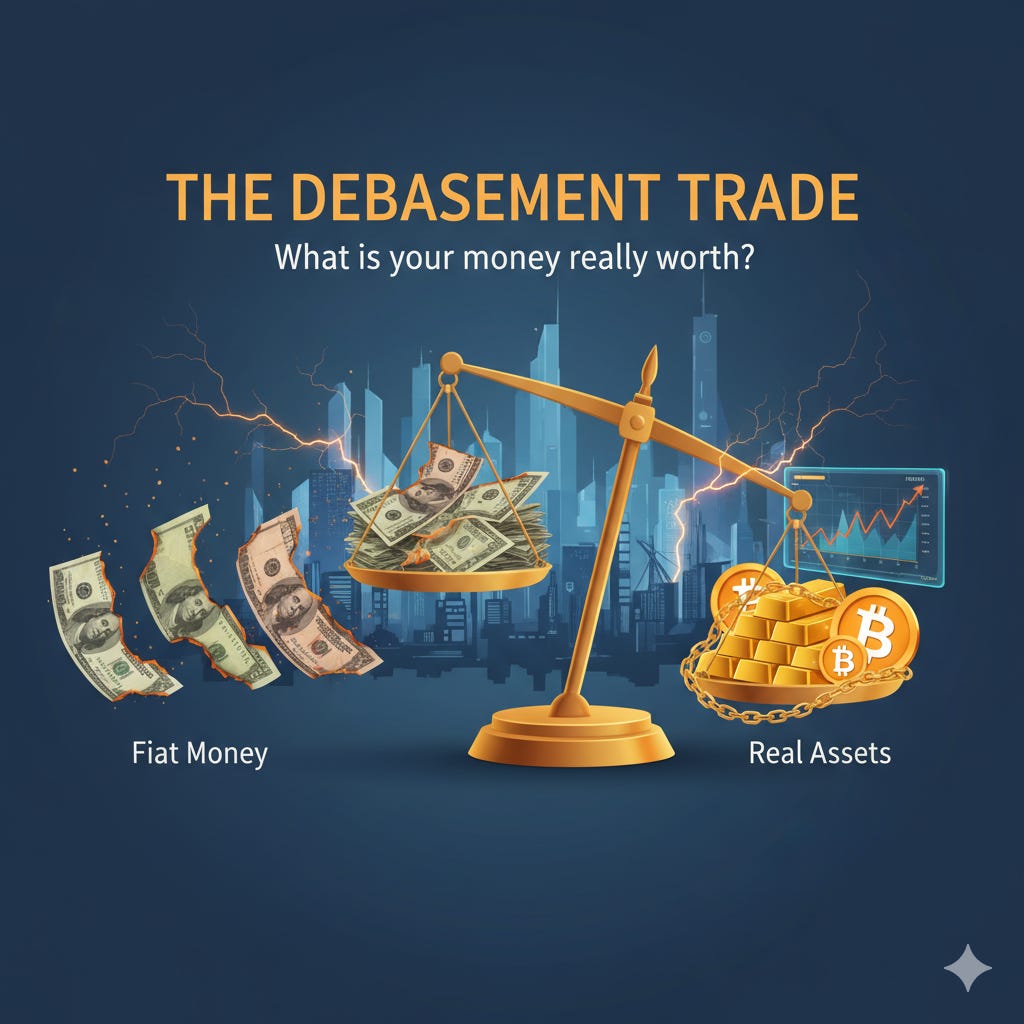

In every economic cycle, there comes a point when people start asking a simple question: “What is my money really worth?”

That’s what’s happening right now across the world. The U.S. dollar, the Japanese yen, and even the euro are showing signs of weakness. Gold and Bitcoin, on the other hand, are rallying. This shift is what economists are calling the “Debasement Trade.”

But let’s go beyond the headlines. What’s really going on here?

The Meaning of “Debasement”

Historically, “debasement” meant mixing cheaper metals into gold or silver coins — literally reducing their purity. Today, it happens in a different way. Central banks print more money, governments run massive deficits, and the purchasing power of paper money quietly falls.

When that happens, investors naturally look for assets that can’t be printed or manipulated — assets that hold their value because they are scarce and real.

That’s why gold and Bitcoin are both shining right now.

Gold has been humanity’s trusted store of value for thousands of years. Bitcoin, in a sense, is gold’s digital successor — capped at 21 million coins and independent of any government. When trust in fiat money fades, people don’t necessarily become greedy. They simply become protective. They move toward things they can understand and control.

What’s Triggering This Now

Global politics is becoming unstable. In Japan, a new prime minister promising more stimulus caused the yen to fall sharply. In France, political uncertainty rattled the euro. And in the United States, a prolonged government shutdown has weakened confidence in the dollar.

All of this has one common thread — debt.

Governments across the world are spending more than they earn. To keep their economies running, they print money and cut interest rates. But this also fuels inflation and weakens their currencies over time. Investors see the writing on the wall — and they are acting before the problem becomes too big to ignore.

The Shift Toward Real Assets

This is not just a speculative move. Smart money is flowing into assets that represent stability in an unstable world. Gold and silver are rising. Bitcoin is being called “digital gold” once again.

It’s not about chasing profits. It’s about preserving trust.

Because ultimately, money is not about paper or numbers on a screen — it’s about collective belief. When that belief weakens, we move toward things that are harder to destroy.

What We Can Learn

The “Debasement Trade” is not a short-term trend. It’s a mirror reflecting our global financial system — over-leveraged, over-extended, and increasingly dependent on political decisions rather than productivity.

As entrepreneurs and investors, this is an opportunity to think deeply about value creation. Real wealth doesn’t come from speculation — it comes from building, serving, and owning assets that cannot be easily copied or inflated away.

Gold and Bitcoin may protect your money. But your skills, brand, and business — the things you build with your own hands and mind — will protect your future.

That’s the real antidote to debasement.