Go Fork Yourself, BCH (Bitcoin Cash)

Bitcoin almost died in 2017 and came back stronger.

A lot of people who discovered Bitcoin in 2020 or later do not really know much about the blocksize wars. In 2017, Bitcoin almost died. In this article, we will have an overview of what happened.

Different people tell different stories about this war and there are many perspectives to this story. There is a book dedicated to this named The Blocksize War: The Battle over Who Controls Bitcoin's Protocol Rules. I have read this book and also learned about this from many podcasts.

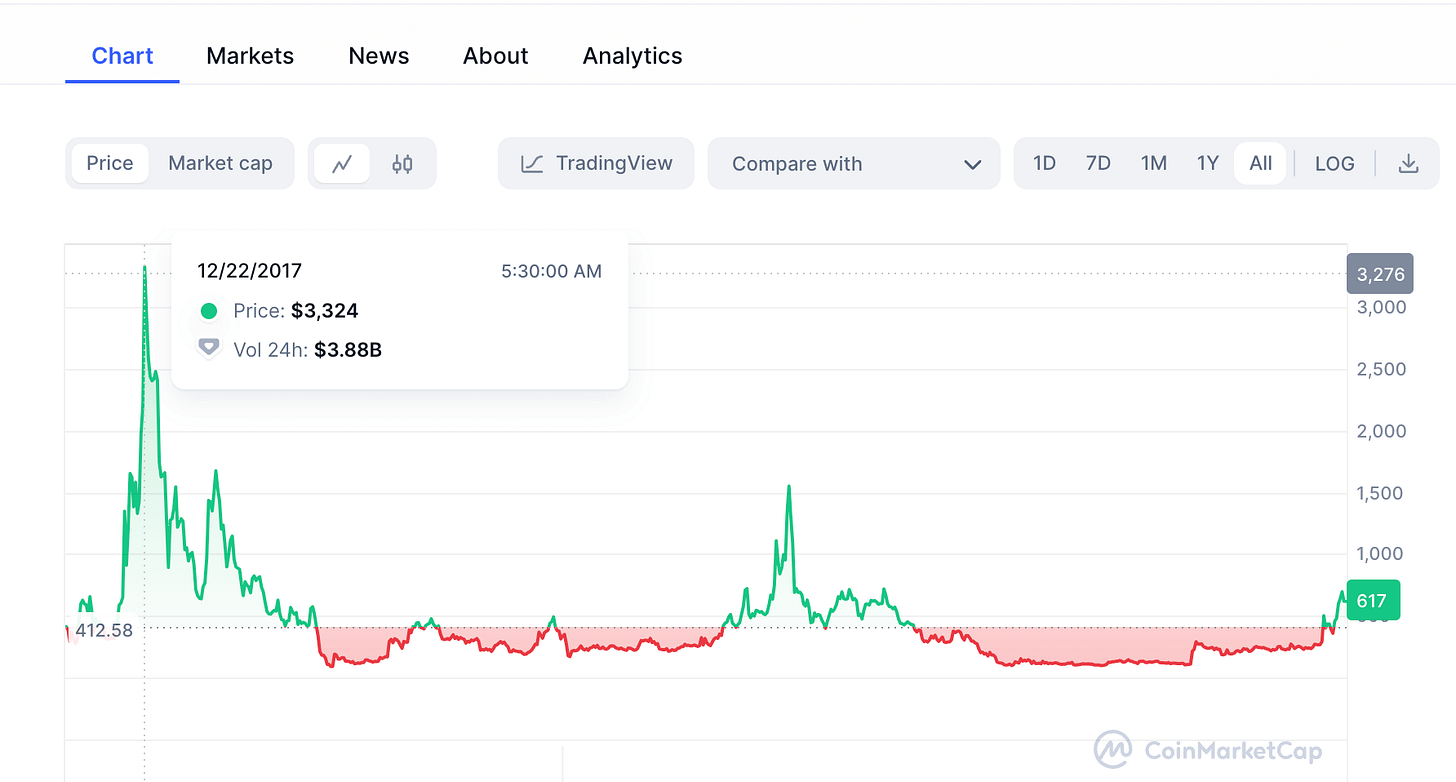

Did you know that there is a fake Bitcoin out in the market right now? It’s called Bitcoin Cash and the symbol is BCH. It also has 21m coins in circulation, has a similar halving schedule, and is priced at around $600 right now.

On 22nd December 2017, it hit an all-time high of $3324.

Where did this coin come from and how did this happen?

You might have learned from my previous articles and posts that Bitcoin’s ledger, the record of all the transactions on the Bitcoin blockchain, from 2009 to now is around 560 GB in size. You can explore the blockchain data from mempool.space website and you can also download this entire ledger to your local computer using the Bitcoin Core software. Anyone can download the open-source Bitcoin Core software from Bitcoin.org.

Whenever you use a Bitcoin wallet (both hot and cold), the wallet balance is fetched from the ledger. The ledger is hosted on a server and this is called a Bitcoin node. Every Bitcoin node in the world has a copy of the entire blockchain. If you are transacting on the Bitcoin network, once the block is confirmed, the transaction detail is updated to lakhs of computers across the world.

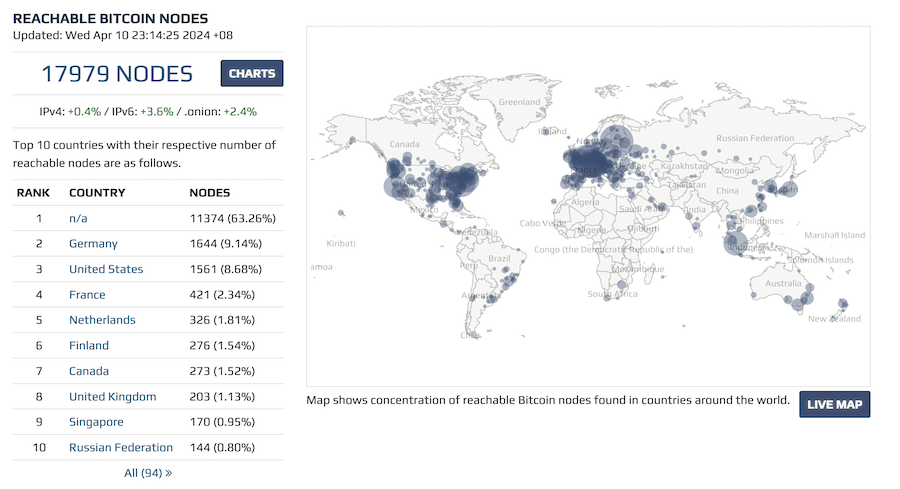

Though there are lakhs of computers across the world having a copy of the entire blockchain, we only have around 17,000 nodes that are reachable. Reachable nodes allow you to check your wallet balance against their ledger data. The reachable nodes in the world is displayed at Bitnodes.io

Bitcoin is basically the Bitcoin ledger. Without the ledger of all the transactions from 2009, Bitcoin doesn’t exist. One of the key qualities of Bitcoin is that it is decentralized. When we say it is decentralized, we basically mean that the ledger has many copies. There is no central copy. All the nodes are equal. You will be able to fetch your wallet balance against any of these nodes.

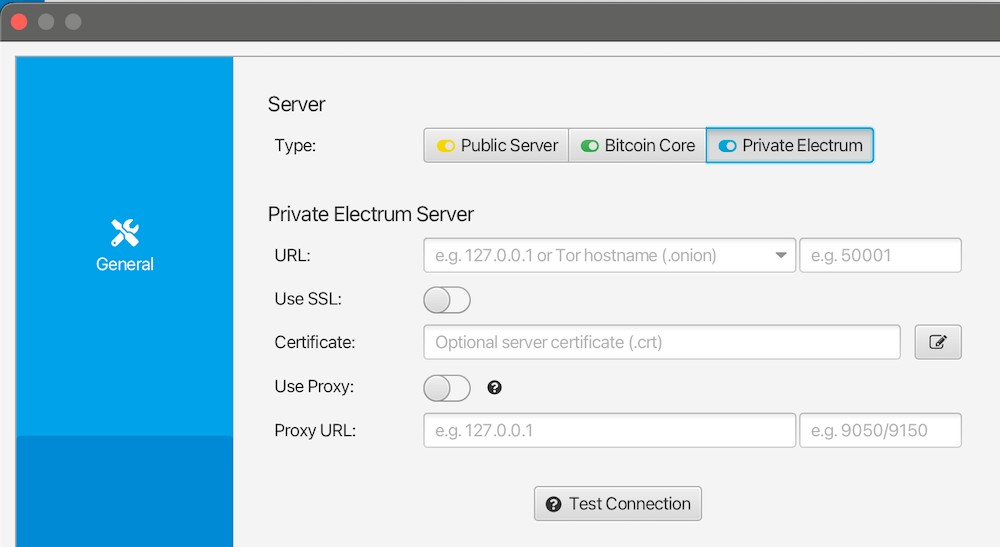

If you are using an open-source wallet like the Sparrow Wallet, you will find options in the settings to choose a public server to fetch your wallet balance OR you can connect your own server. You can fetch your wallet balance against your own copy of the ledger data of a 1.4 Trillion dollar asset that is Bitcoin. How cool is that?

That’s why no one can change the supply limit of Bitcoin. All the nodes have to change it and no one can attack hundreds of thousands of nodes at the same time. It’s a consensus like the English language or like the rules of Chess.

If someone wants to modify the English language and wants to create a variant of it, it will not happen because all the people in the world should be convinced to adopt the new language. They might be able to convince a small group of people to speak the new language but not all.

That’s exactly what happened with Bitcoin Cash (BCH).

A group of people including some Bitcoin development companies and miners argued that Bitcoin needs to scale. Right now Bitcoin is too slow and transacting on the blockchain is costly. For every transaction one needs to pay miners a transaction fee. They argued that if the block sizes are bigger then more people can transact on the network at a faster rate and that’s how Bitcoin scales.

Another group of people who are hardcore Bitcoiners argued that we cannot increase the size of the blocks and let Bitcoin be slow because it’s a final settlement layer. It is important to keep Bitcoin light so that anyone can run a node without having heavy computing and memory power. If the ledger is 100 TB in size, everyday people cannot have a local copy of the entire blockchain and hence Bitcoin won’t be decentralized enough to make it valuable. People can build Layer 2 solutions that are faster and have negligible fees. Today we have the lightning network as Bitcoin Layer 2. We don’t need BCH.

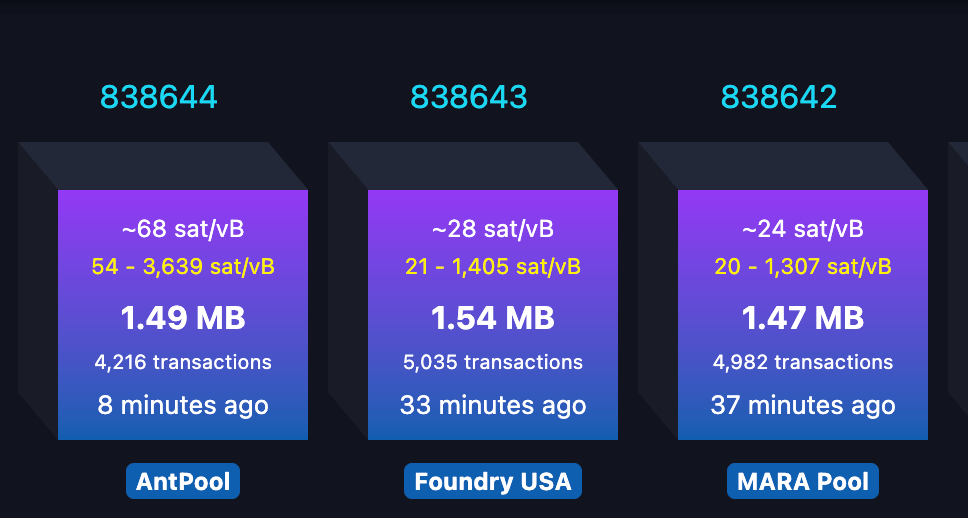

The Bitcoin forked into two versions of Bitcoin. A hard fork means that until the decision is made, the blockchain is the same, but after the deadline, there will be 2 chains with the same history but different futures. The free market can choose which is the real Bitcoin. People chose the smaller blockchain Bitcoin. As of now, each block in the Bitcoin blockchain is 1.5 MB to 2 MB in size. Each block contains a few thousand transactions in it. As soon as a block is mined, it is updated on all the nodes.

144 blocks are produced in a day and the ledger increases in memory size by around 250 mb per day. That’s 1 GB every 4 days.

The way the fork works for users is that every person who owns Bitcoin in their wallet will also have 1 BCH in their Bitcoin Cash wallet.

The big blockers thought that people would dump BTC to buy BCH. But people ended up dumping BCH. BTC has stood the test of time. People preferred smaller blocks though it is slow and has higher transaction fees.

2017 was an uncertain time for BTC. We are glad we had that war in 2017 instead of 2024 because in 2024, it will rock the boat a lot and institutions and countries won’t have confidence to invest in Bitcoin. Now that Bitcoin has proven itself to be resilient, even with changes being pushed by miners, Bitcoin stands tall as people’s money that is very resilient to attacks.

Hopefully, we will never have such a war again in the future. We might have some problems when the on-chain fees go too high (like $500 per transaction) but there is nothing we can do about it right now. The chances that Bitcoin will die in the future is little to none. That’s why studying about the blocksize wars will give you more confidence in Bitcoin’s current version.