BlackRock is Bitcoin's Marketing Team

BlackRock is promoting Bitcoin to high net-worth investors

Until January of 2024, Bitcoin did not have a marketing team. The Securities Exchange Commission in the US (SEC) approved Bitcoin ETFs. Bitcoin ETFs help corporations and people in the traditional finance system to be exposed to Bitcoin. Ideally, anyone who has Bitcoin should keep it in cold storage with their own private keys but a lot of people cannot or do not want to do that.

BlackRock and other Bitcoin ETF providers charge an annual fee for holding Bitcoin for their clients. And now they want more AUM (assets under management). They are promoting Bitcoin to their investors. Here are some recent shots of the slides making rounds on social media.

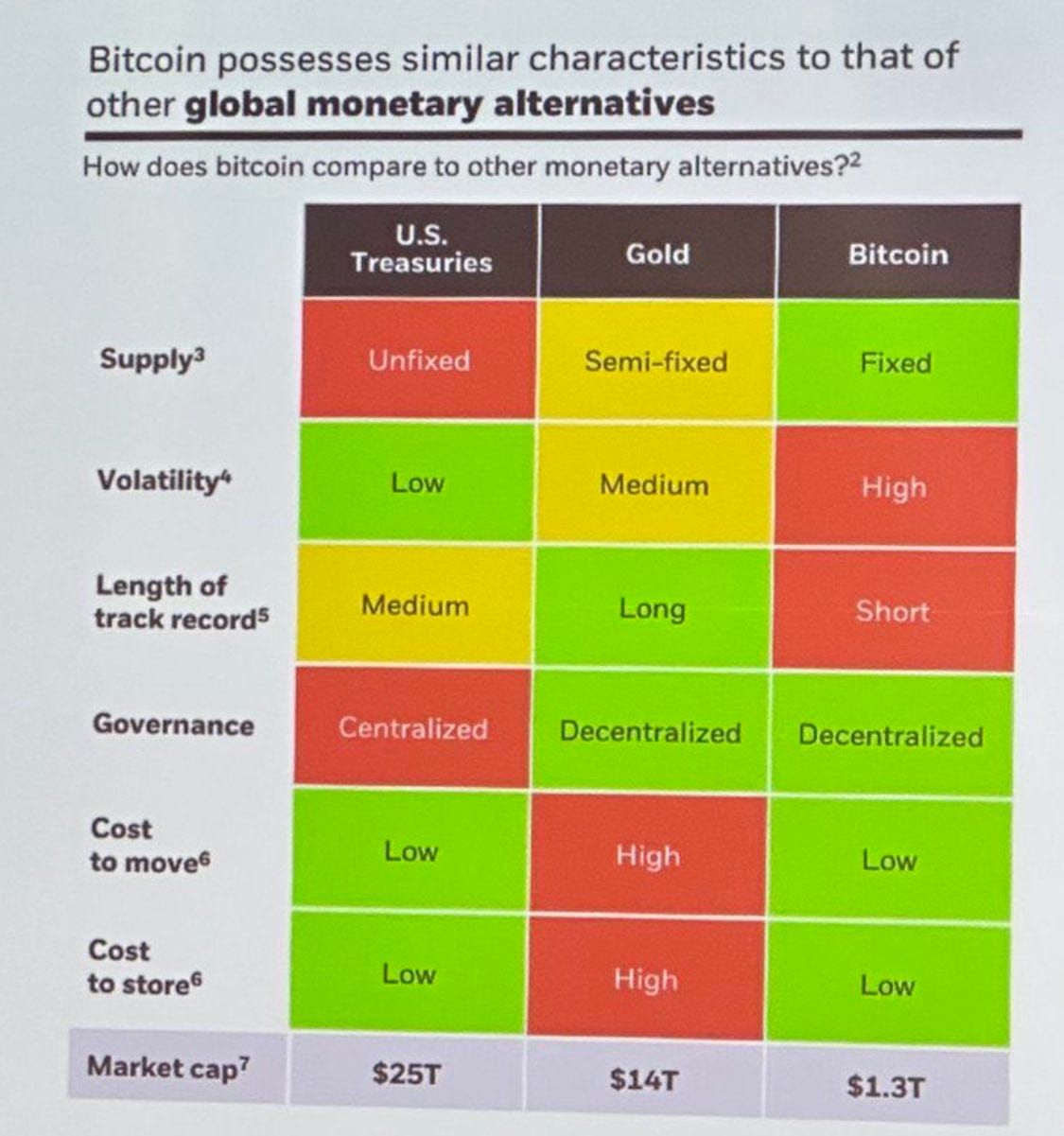

BlackRock says Bitcoin is “Risk Off” as a global monetary alternative, while ETH is “Risk On” as a blockchain play. The world is finally able to differentiate clearly between digital gold (bitcoin) and securities (altcoins).

They are now talking about the “history of money”. We have forgotten that paper currencies without gold backing are less than 60 years old. The world never had money backed by debt.

Bitcoin is now seen as a global monetary alternative.

Bhutan has accumulated 13,000 Bitcoins through mining. El Salvador has 5,000+ Bitcoins. More countries will start putting Bitcoin on their balance sheet. There are only 21 million. This is a game of who accumulates the most Bitcoin, the fastest.

Bitcoin is maturing as an asset class. The volatility is decreasing and the market cap is increasing in the long term.

Bitcoin is being compared to gold. And not stocks or the stock market indexes.

It’s high time that you allocate a small % of your portfolio to Bitcoin.

Cheers,

DD