Amazon Shareholders Push for 5% Bitcoin Allocation

Amazon is more valuable than all the Bitcoin combined. Not for long.

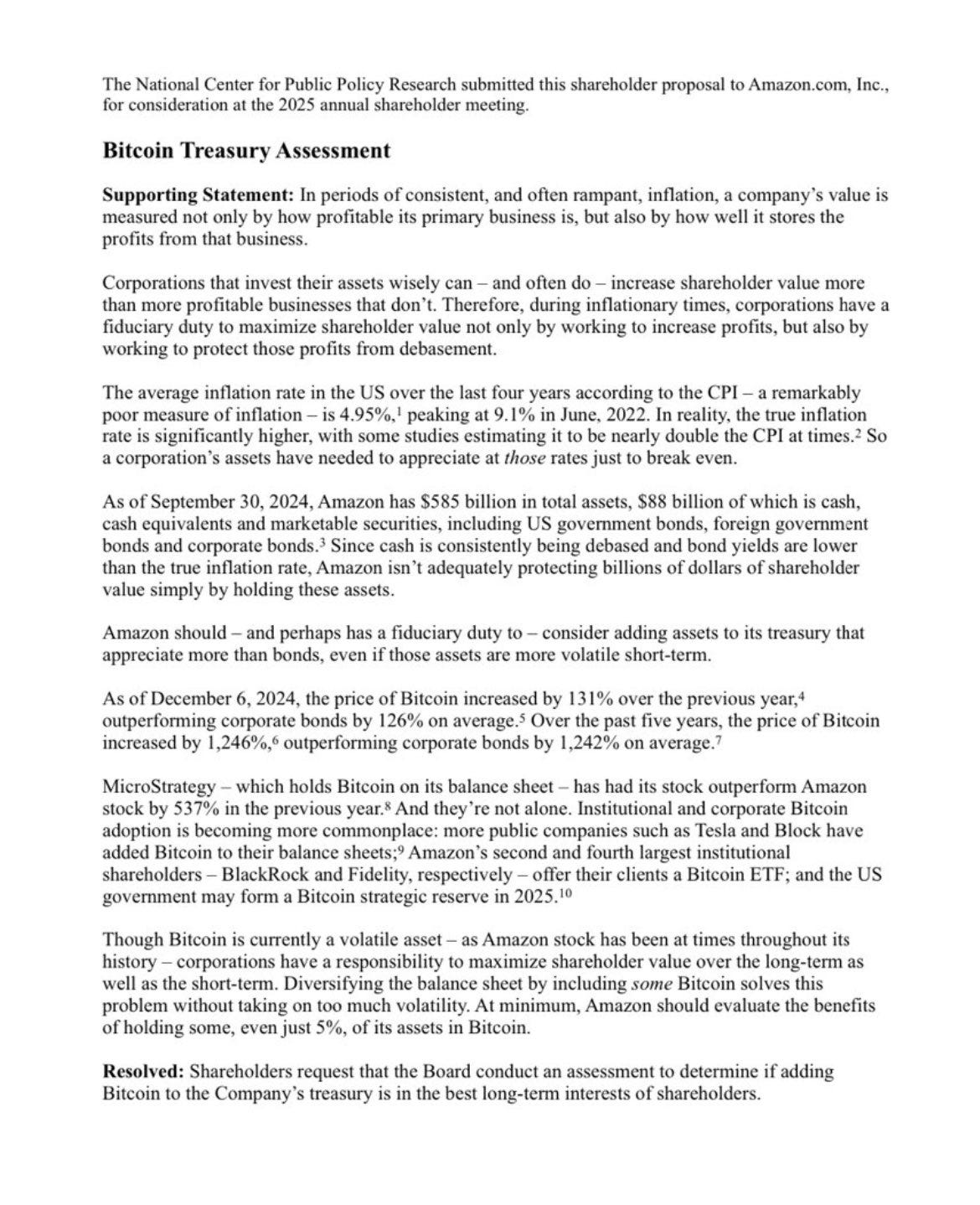

A group of Amazon shareholders, spearheaded by the National Center for Public Policy Research (NCPPR), has called on the e-commerce giant to allocate at least 5% of its assets to Bitcoin. This proposal, revealed by Tim Kotzman, highlights the potential of Bitcoin to act as a hedge against inflation and serve as a strategic diversification tool for Amazon’s treasury.

The proposal underscores Bitcoin’s superior performance compared to traditional financial instruments like corporate bonds. It cites the example of MicroStrategy, a company that holds Bitcoin on its balance sheet and has seen its stock price soar by 537% over the past year, outperforming Amazon. The letter also points out that other major corporations, such as Tesla and Block, have adopted Bitcoin as a treasury reserve asset.

Moreover, BlackRock and Fidelity, two of Amazon’s largest institutional shareholders, have embraced Bitcoin ETFs, reflecting the growing mainstream acceptance of the cryptocurrency. The proposal argues that Amazon should follow suit to stay competitive in a rapidly evolving financial landscape.

While Amazon has yet to issue a formal response, the company has previously explored blockchain technology, particularly in supply chain management. This history of interest in blockchain could indicate potential openness to digital asset investments.

The proposal is part of a broader movement toward Bitcoin adoption within the corporate sector. In October, NCPPR submitted a similar request to Microsoft, urging them to invest in Bitcoin. However, Microsoft’s board recommended shareholders vote against the proposal, citing the company's broad asset allocation strategy. The board also warned shareholders of potential legal ramifications if Microsoft missed out on Bitcoin's potential value growth. Microsoft shareholders are set to vote on this proposal on December 10, 2024.

If Amazon’s board accepts the proposal, it will be included in the proxy statement for the 2025 annual shareholders meeting, where shareholders will vote on its adoption. Major institutional investors like Vanguard, BlackRock, and Fidelity, which have significant voting power, will play a key role in determining the proposal’s fate.

This push for Bitcoin adoption reflects a growing trend among corporations to consider cryptocurrency as a treasury asset. Proponents argue that Bitcoin's decentralized nature and deflationary design make it a strong hedge against inflation, especially in uncertain economic conditions.

If Amazon accepts the proposal, it could mark a significant milestone for Bitcoin's mainstream adoption. It would also signal a shift in how major corporations approach asset allocation, potentially encouraging other companies to follow suit. However, if Amazon’s board advises against it — similar to Microsoft — it may prompt debate about the future role of Bitcoin in corporate treasuries.

The outcome of Amazon’s decision could influence not only its own financial strategy but also broader corporate adoption of Bitcoin, making this proposal one to watch closely.