499,096 Bitcoins: MicroStrategy’s Bitcoin Play

The Ultimate Trojan Horse for Institutional Adoption

Michael Saylor’s relentless Bitcoin acquisition strategy has reached a new milestone, with Strategy (formerly MicroStrategy) now holding nearly 500,000 BTC, valued at over $33.1 billion. This aggressive accumulation is reshaping how institutions interact with Bitcoin and redefining what it means to be a corporate treasury in the 21st century.

A Loophole in the Traditional Financial System

Many institutional investors want exposure to Bitcoin, but regulatory hurdles, risk-averse boards, and traditional finance constraints prevent them from directly holding BTC. Strategy has become the ultimate Trojan Horse - offering these investors indirect Bitcoin exposure through its stock. Instead of holding Bitcoin outright, pension funds, hedge funds, and even state treasuries are snapping up Strategy shares as a proxy for Bitcoin.

BlackRock, the world’s largest asset manager, has increased its stake in Strategy to 5%, and at least 12 states in North America have reported holding Strategy stock in their pension funds or treasuries, totaling $330 million. This signals growing institutional confidence in Bitcoin—but through an indirect vehicle.

The $2 Billion Bitcoin Buy: Strategy’s Latest Move

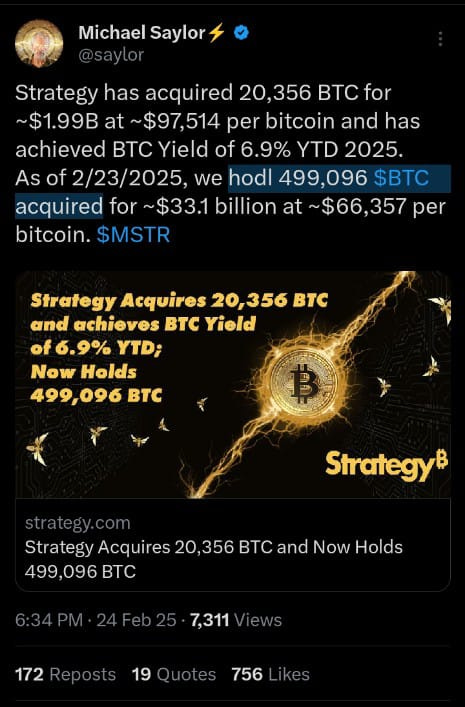

On February 24, 2025, Strategy announced another $2 billion Bitcoin acquisition, adding 20,356 BTC at an average price of $97,514 per BTC. This was made possible through a senior convertible note offering—a 0% coupon bond maturing in 2030, structured to raise capital without traditional debt burdens.

This isn’t a one-off event. Strategy’s 21/21 Plan aims to raise $42 billion over three years, split between equity and fixed-income securities, all directed toward buying more Bitcoin. So far, the company has raised $20 billion, fueling its Bitcoin buying spree largely through debt and convertible notes.

A Free Market: The Morality of Holding 2.3% of Bitcoin’s Supply

Some critics argue that no single company should hold 2.3% of Bitcoin’s total supply. But Bitcoin is the first truly free market of money, and in a free market, anyone with the foresight and conviction to accumulate Bitcoin should be free to do so. If individuals, governments, or corporations want more Bitcoin, they simply need to buy it.

Moreover, the more Bitcoin Strategy acquires, the more it pushes the price up—which, in turn, attracts retail and institutional investors who previously ignored Bitcoin. Historically, retail adoption surges only when price action forces people to pay attention. If Strategy’s moves accelerate this process, it could be the catalyst that drives Bitcoin deeper into the mainstream.

Unrealized Profits & The Long-Term Vision

Despite posting a $670 million net loss in Q4 2024, Strategy is sitting on $14.8 billion in unrealized Bitcoin profits. The company has an average purchase price of $66,357 per BTC, meaning as long as Bitcoin stays above this level, the strategy remains sound.

Saylor’s vision has been clear from the beginning:

Accumulate Bitcoin without selling.

Use traditional finance tools to raise capital.

Provide institutions a regulated, familiar way to gain Bitcoin exposure.

Outperform traditional fiat-based treasuries over the long term.

The Future of Strategy & Institutional Bitcoin Adoption

As Bitcoin adoption increases, more companies may follow Strategy’s playbook. It’s a model that allows corporations to hedge against fiat devaluation while creating shareholder value. And with institutions like BlackRock doubling down on their exposure, the trend is only accelerating.

The question isn’t whether Strategy is buying too much Bitcoin. The real question is: Why aren’t more companies doing the same?

Bitcoin is the hardest money ever created, and those who understand this are acting accordingly. Whether you agree with Saylor’s methods or not, one thing is certain—Strategy is leading the charge toward a Bitcoin standard.